Retirement Calculator

Retirement Calculator: Your First Step to Financial Freedom

Let’s be honest, the word “retirement” can bring on a mild sweat. It feels huge, distant, and frankly, a little terrifying. For years, I avoided even thinking about it. My idea of a retirement plan was just hoping for the best. But here’s something I learned: ignorance isn’t bliss, it’s just stressful. The first step I took to replace that anxiety with confidence didn’t involve a spreadsheet with a million tabs or a stuffy meeting with a financial planner. It was much simpler. It was a retirement calculator.

Think of a retirement calculator not as a crystal ball, but as a compass. It gives you a direction. It takes that giant, scary idea of a “nest egg” and turns it into a tangible savings goal. It’s the starting point for building a real financial strategy. And the best part? You can use one right now, for free, in the next five minutes.

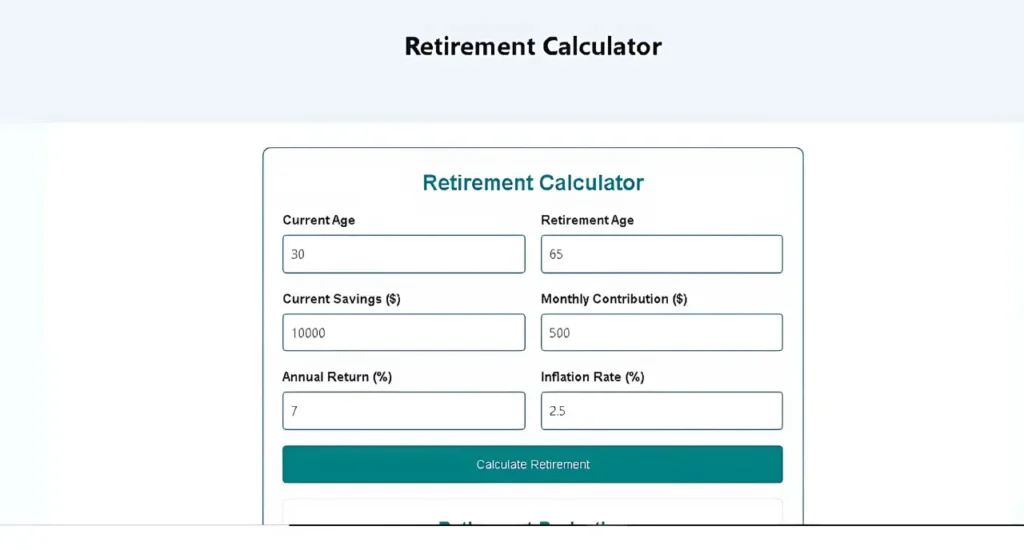

How to Use a Retirement Calculator (Without Getting Overwhelmed)

I remember the first time I pulled one up. All those boxes—current savings, contribution rate, expected return—it felt like a test I hadn’t studied for. But it’s simpler than it looks. Let’s walk through it.

- Enter Your Basic Information

This is the easy part. You’ll plug in your current age and your desired retirement age. Don’t overthink the retirement age too much for now; you can always change it later to see different scenarios. This is about getting a baseline. - Input Your Financial Snapshot

Here’s where you need a few numbers.

Current Savings: How much do you have saved for retirement right now? Be honest! Include your 401(k), IRAs, and any other dedicated retirement accounts.

Monthly Contribution: How much are you adding to those accounts every month? Include your contribution and any employer match.

Expected Rate of Return: This one trips people up. It’s a projection of how much your investments will grow each year. A common, historically-based estimate is between 6-8%. I tend to use a more conservative 6% to be safe. You’re not trying to predict the future, just make a reasonable assumption. - Set Your Assumptions

The calculator will also ask for an inflation rate. This is key. It ensures your future “million-dollar nest egg” actually has the buying power of a million dollars. Most calculators default to 2-3%, which is a solid historical average.

Once you hit “calculate,” you’ll see a graph and a final number. Don’t panic if it’s huge, and don’t get complacent if you look on track. This is just your starting point.

TOOL TIP: Play with the numbers! See what happens if you increase your monthly contribution by just $100. Or what if you work two extra years? This is where the calculator becomes a powerful simulator for your financial future.

Your Top Questions About Retirement Calculators, Answered

How do you use a retirement calculator?

To use a retirement calculator, first enter your current age and desired retirement age. Next, input your current retirement savings and your monthly contribution. Finally, set your assumptions, including an estimated rate of return (6-8% is common) and an inflation rate (2-3% is typical). This will give you a projection of your future nest egg.

How accurate are these retirement calculators?

I get this question all the time. People want to know if they can bank on the number they see. The honest answer is that a retirement calculator is a tool for estimation, not a guarantee.

Its accuracy depends entirely on the assumptions you put in. If you assume you’ll get a 12% return on your investments every single year and that inflation will be zero, your results will be wildly inaccurate. However, if you use conservative and realistic numbers, it can provide a surprisingly solid forecast.

The takeaway: A retirement calculator is as accurate as your inputs. Use conservative estimates for a more reliable projection.

NOTE: Many advanced calculators, like those offered by investment firms like Vanguard, sometimes include a Monte Carlo simulation. This feature runs thousands of potential market scenarios to give you a probability of success, which is a much more nuanced (and in my opinion, better) way to look at the numbers.

What if the calculator says I won’t have enough money?

First off, take a breath. This is incredibly common and it’s not a final verdict on your future. In fact, it’s a gift. Seeing a shortfall now gives you time to fix it.

This happened to me when I first ran the numbers. My heart sank. But then I saw it as a puzzle to solve. There are several levers you can pull. You can increase your monthly savings, you can adjust your asset allocation to aim for a slightly higher return (while understanding the risks), or you could plan to work a few years longer. Often, a small adjustment now can make a massive difference in 30 years thanks to the power of compound interest.

The takeaway: A projected shortfall is a call to action, not a reason to panic. Use it as motivation to adjust your savings plan.

FUN TOOL TIP: Look for a FIRE (Financial Independence, Retire Early) calculator online. Even if you don’t plan to retire at 40, these tools are great at showing you how aggressive savings can dramatically accelerate your journey to financial freedom.

What’s the difference between a simple retirement calculator and a 401(k) calculator?

This is a great question because it gets into how these tools are specialized. A simple retirement calculator gives you a broad overview—your total nest egg based on all your savings.

A 401(k) calculator is a hyponym, a specific type of retirement calculator. It focuses only on your 401(k) plan. It will often have unique fields for things like employer matching rules and vesting schedules. It’s designed to answer the question, “What will this specific account be worth at retirement?” You’d use it to see if you’re taking full advantage of your workplace plan. You need both for a full picture.

The takeaway: Use a 401(k) calculator to optimize your workplace plan and a general retirement calculator to see your total financial picture.

NOTE: Don’t forget to factor in Social Security benefits. Most simple calculators don’t include this, but the Social Security Administration has its own estimator on their website. Your total retirement income will be a combination of your savings, pensions, and Social Security.

Final Words

A retirement calculator won’t solve all your financial worries, but it will give you something invaluable: clarity. It turns a vague, intimidating concept into a concrete number you can work towards. In my experience, seeing the path is the most powerful motivator to start walking it.

So go ahead, take five minutes and plug in your numbers. Don’t be afraid of what you’ll see. Be excited that you’re finally taking control. You’re not just playing with a calculator; you’re designing your future.

Once you have your number, your next step is to learn how to make it a reality. You can start by learning more about the assumptions that power your calculation.